Some clients have asked us “what is a certificate of conformity” over the years, and…

How to Pay Chinese Suppliers by T/T Payment (Bank Wire Transfer)

BY RENAUD ANJORAN

T/T stands for Telegraphic Transfer. In other words, an international wire of funds from the buyer’s bank to the seller’s bank.

When a Chinese supplier asks for a T/T payment, what they really mean is they want a wire transfer. (Technically, a T/T is not exactly the same as a wire transfer through the SWIFT system, but the vast majority of people think ofthem as the same thing.)

A wire transfer based on SWIFT is the most common payment method in international trade with Asian countries. It typically takes 3-5 working days to clear, and generally costs between 25 and 50 USD, depending on your agreement with the commercial department in your bank.

What is the most common payment term requested by Chinese suppliers?

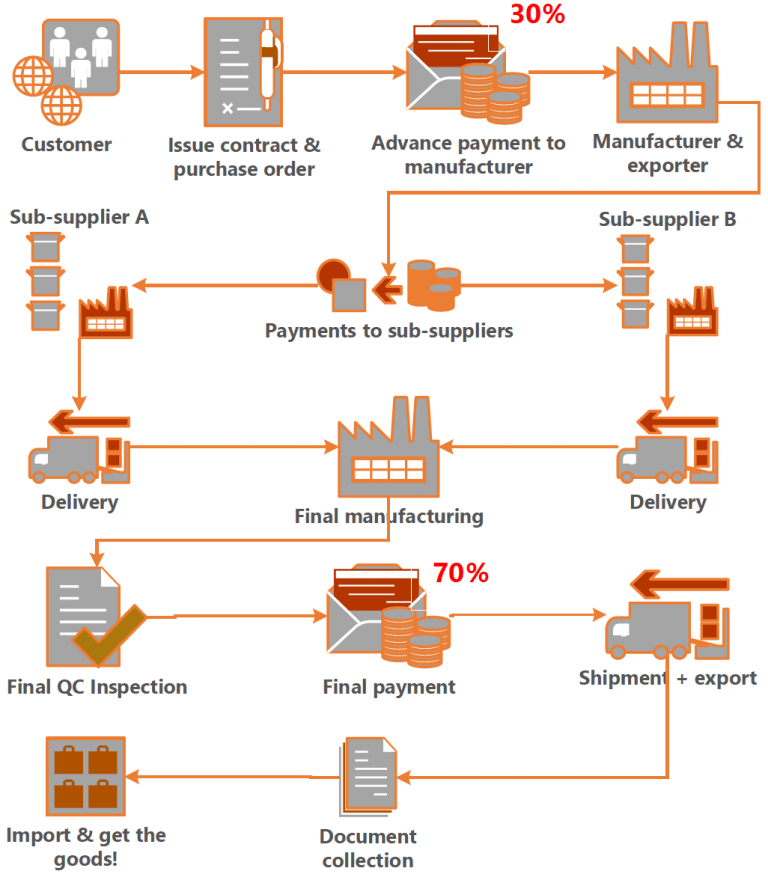

The most common payment method is a bank wire that works this way:

- You have the supplier develop sample(s) until you are confident they know exactly what you want.

- You send a 30% deposit (by T/T) before production starts.

- Your supplier (the manufacturer & exporter) purchases the components and/or materials, and arranges production

- You work with a quality assurance firm to inspect product quality (this is optional but usually a good idea).

- You send the remaining 70% (by T/T) before shipment.

- The supplier ships the goods and sends you the documents by express courier.

In graphical form, it looks like this:

What is another common, and better, payment term?

It is quite similar, except for the end of the process.

- Once the supplier confirms the goods are ready, send an inspector to check quality (again, not a must, but highly advised)

- If quality is OK, release the goods (allow the goods to be shipped out) — this works best if you purchased under FOB terms

- Once the goods are on the ship, the supplier gets the Bill of Lading (B/L), and sends you a copy of it

- If the product name, quantity, etc. are all fine on the bill of lading, you send the final payment to the supplier

- Once the supplier receives the payment, they send you the original B/L

It looks like this:

Why is it better?

- The buyer knows the goods have been shipped out before paying the remainder.

- The supplier knows the buyer can only take possession of the goods after the original bill of lading has been sent.

Can you negotiate this term? If you insist on it from the very start, and if your suppliers are motivated to work with you, probably yes. If you come out as a beginner and your orders are very small, probably not.

How to do a T/T payment?

Contact the commercial department of your bank, tell them you need to wire (for example) 25,000 USD to a company in China, and they will generally give you a form to fill out. If you do T/Ts frequently, your bank probably has an ‘internet banking’ application that will save you time.

Your supplier will probably send you a pro forma invoice that includes their bank account information. I strongly suggest you ask for that information earlier (as part of your pre-qualification of a potential supplier). Many buyers have been scammed by hackers who send invoices with their own bank account information…

I shot a short video that shows how to fill out a T/T application form:

After you have done this, take a screen shot, or get a digital copy, and send it to your supplier.

Important tips:

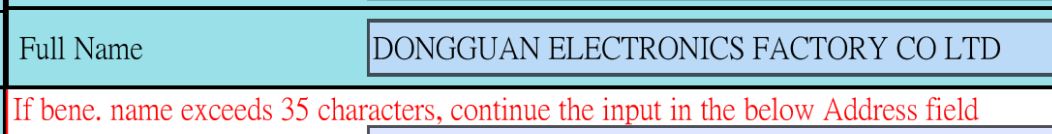

- Make sure to avoid any misspelling, which might cause the payment instruction to be held in limbo for weeks!

- You will need to write the company name in English, not in Chinese. Don’t try to do your own translation job, even if your written Chinese is excellent! It has to match exactly the English name under that is registered in the seller’s bank records.

- If the company name is too long, keep writing it in the “address 1” field. This is sometimes mentioned on the T/T forms of banks that work a lot with China:

How to negotiate better payment terms?

There are various ways you might be able to negotiate for payment of some (or all) of the amount after shipment.

- Your company is well established and famous — think Apple or Disney. The risk of the buyer’s company defaulting is much lower. And the seller want to boast about that prestigious customer in order to get more business.

- You arrange financing of your suppliers — as the buyer, if you have relatively strong financial guarantees and you purchase more than 1 million USD a year, you can work with a company (or a bank department) specializing in trade assurance solutions. Your supplier gets the cash when they need it, and your account is debited much later.

- You have a buying office in China — having a strong presence in-country does help. A supplier that hasn’t been paid in time can pay you visits and take different measures to push you for faster payment.

From: qualityinspection

This Post Has 0 Comments